Growing demand, changing demands

American’s appetite for shrimp grows every year but few realize 93% of our shrimp is imported. Wild-caught production plateaued years ago and, to date, US-based shrimp farming has failed to take hold. Importing farm-raised shrimp has been the only way to meet demand, until now.

While foreign farms work to keep pace with US demand, the landscape is changing. Readily- available, healthy shrimp at reasonable prices is no longer a guarantee. As economies improve, other countries are competing for shrimp once exported primarily to the US. Even when shrimp is available, it is frozen and may be contaminated with bacteria, toxic chemicals and/or antibiotics.

https://www.sustainablefish.org/Media/Files/SR-Documents/Shrimp-Aquaculture-_-Asia-Farmed-Shrimp-SR

In a talk about the future of sustainable aquaculture, Barry Gold, Director Environment Program of the Walton Family Foundation (A Wild Ride to the Future: Shrimp Tails Magazine, p6-7 March 2019) says “I sometimes feel as though the aquaculture sector is like driving down an unknown highway without a GPS system. Population growth the world over, a growing global middle class demanding high-quality protein sources, and global consumptive dietary tastes are changing both what people eat and the ways people eat in todays world. These changing demands are reflected in the global international trade in food commodities and, most acutely to the readers of Shrimp Tails, in the aquaculture sector. Aquaculture businesses must respond to these demands by providing

good-quality products to restaurants, retailers and consumers in an ever-competitive global seafood market. Royal Caridea is an aquaculture business that can respond to these markets at least in the beginning here in America.

Consumer attitudes are also evolving. Americans today care more about quality and product sourcing. They want antibiotic-free food, raised in an environmentally responsible manner and where workers are treated fairly. American and EU consumer basically don’t know what fresh shrimp tastes like unlike consumers from Asian and Latin American countries.

Increased consumption and changing attitudes are not just US realities. China, the EU, Japan and other regions with large markets facing the same issues. Some, like the EU, are considering import restrictions from selected countries due to health concerns. Others are seeking reliable sources of protein to feed growing populations.

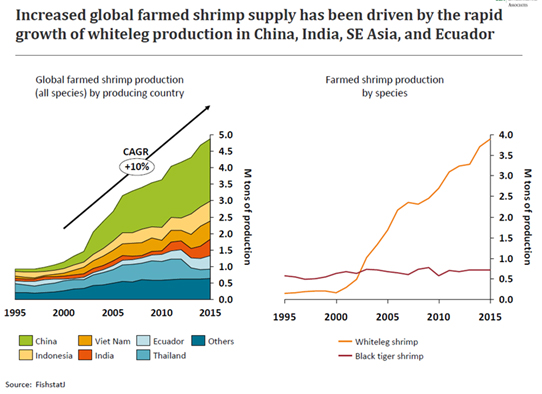

Globally farmed shrimp supply has expanded by the rapid growth of production in China, India, S.E. Asia, and Ecuador (see graph presented above) and Americans have benefitted greatly in terms of availablilty.

But, things are changing:

- Despite making up 5% of global seafood production, shrimp is responsible for 15% of the production value of traded seafood. The shrimp market is expected to register a compounded annual growth rate (CAGR) of 5.2% during the forecast period, 2019-2024, whereas a GAGR of 3% for the global seafood market is estimated.

- China is now a net importer (land abuse and disease). China is presently purchasing >50% of Ecuador’s production.

- The US is by far the most important trading country for all major shrimp producers, but demand from China is quickly growing and threatens the potential effectiveness of western demand-driven intervention strategies. The size and value of the American currency guaranteed the US a seat at the table. China and the EU are disrupting long held positions.

- The Chinese market alone is two and a half times the size of the US market and the EU market is on par with the US.

- Shrimp commodity markets this decade have been volatile because of shrimp disease and more recently, shrimp imports from India and S.E. Asia were rejected because of contamination with human pathogens. The EU has considered totally banning importation of Indian shrimp because of microbial contamination.

Wild caught shrimp has been an integral part of American trade but much of the north Atlantic cold water shrimp fishery has been closed off the east coast of Canada and USA due to over- fishing. Likewise, the warm water shrimp fishery is failing due to over-fishing

A proprietary approach to growing large, healthy shrimp in a sustainable manner is just one piece of the puzzle. There must also be a readily addressable market.

The US market for imported shrimp has been growing steadily. In 2017, the country imported over 600,000 tons of shrimp, in 2018 that number rose by 20% and the US is on track to import 700,000 tons of shrimp during 2019.

The time when US based aquaculture can be ignored is fast approaching. It is being driven by availability and health concerns associated with imported product (News Tab: Consumer Reports).

Royal Caridea is positioned to lead

Shrimp production is an industry ripe for transformation. By moving from resource-intensive production far from market to a more local, sustainable, reliable and commercially-viable alternative, rising demand and changing market tastes can be satisfied. Royal Caridea has developed its technology to meet these challenges.

Sales and Marketing Plan — Local Based, Local Grown, Nationwide Reach

Locally-sourced food, including seafood, is the number one culinary trend, according to the National Restaurant Association’s annual “What’s Hot 2016 Culinary Forecast.” “Hyper-local sourcing” was the number four trend out of 20 top food trends for 2016, and sustainable seafood was ranked 9th. Locally sourced, sustainable shrimp production is what Royal Caridea (Royal Caridea) is all about. Royal Caridea is designed to meet every one of these food industries demands. Royal Caridea’s technology will produce locally grown, locally sold, and locally distributed sushi grade shrimp.

Royal Caridea has set out a roadmap to commercialization with a path to sustainable market presence and significant profitability. Our plan entails a four-stage production approach along with a three phase Marketing and Sales Plan .

Royal Caridea is currently positioned to move into the shrimp production business with its two-pronged approach. Stage One, Royal Caridea will reopen an existing traditional open-air shrimp farm in Arizona, from which shrimp has been farmed and profitable for many years.

The Farm can currently produce up to 150,000 pounds of shrimp per year and with some modifications as much as 200,000 lbs. There are >20 acres of production ponds ready to bring back online. Pond shrimp production could start as early as April 2020 with pond raised shrimp being harvested from August through September 2020. Shrimp will be offered for sale to chefs, restaurants and directly to consumers through our retail outlet as fresh never frozen or processed and packaged for sale. Fresh never frozen will command a retail price greater than the sale price of processed shrimp, which in the recent past has commanded, on average ~$12.50/pound.

Royal Caridea will launch Stage Two in 2021 when it brings online its first in-door Vertical Shrimp Farming Technology Plant. This first vertically stacked two container system (Two Container System) will be used to trial all aspects of the newly developed Technology even as it provides Royal Caridea shrimp to the local markets. The 1/4 plant will demonstrate Royal Caridea’s scale-up capability leading to building and operating their first 1.3 million lb. commercial plant which will be located on the above-mentioned pond site.

Royal Caridea has chosen to enter the USA Market with its GEN 2 Technology shrimp with two products:

Fresh Live – Today’s 16g Fresh Live shrimp account for a small fraction of the USA market. It is an underserved market especially in locations such as New York, Los Angeles, San Francisco, Chicago, Houston and Phoenix, i.e., cities with large Asian populations. This product will attract local consumers. It will also attract seafood restaurateurs and chefs and several specialty /regional seafood markets. Fresh Live shrimp will command premium prices of $14 per lb.).

Fresh Never Frozen – Large 26g, pathogen free, sustainably produced fresh never frozen shrimp. This product is in high demand by seafood consumers as well as numerous upscale restaurants and seafood markets. Fresh Never Frozen shrimp will command premium prices of $16 per lb.).

Royal Caridea will open and operate a retail outlet strategically located in the Greater Phoenix Metropolitan area. Our retail outlet will be the first point of distribution to reach the general public where we sell both live and fresh never frozen shrimp. From our market analysis we expect that 20% to be sold live and 80% to be sold fresh never frozen. The focus of Plant 1 is to introduce our branded shrimp products to the market to learn about consumer reactions, and to access sales acceptance and sale-through adoption.

Stage I

Stage I is complete.

Stage II

Marketing and Sales Plan

Initially, RC will build and operate a 170K lb./yr. shrimp plant (Plant 1). The RC market and sales plan is based on a three-phase approach.

- Phase I – Introduce our branded shrimp products to the market

RC will open and operate a retail outlet strategically located in the Greater Phoenix Metropolitan area. RC will establish a retail store (approximately 2,500-sq. ft.) in a strip mall located on the east side of Phoenix (Mesa, Tempe, Scottsdale or Chandler). The location will be selected based on proximity to pre-selected demographics, transportation corridors, and mitigation of associated costs of operation. Our retail outlet will be the first point of distribution to reach the general public where we sell both live and fresh never frozen shrimp. From our market analysis we expect that 20% to be sold live and 80% to be sold fresh never frozen. The focus of Plant 1is to introduce our branded shrimp products to the market to learn about consumer reactions, and to access sales acceptance and sale-through adoption.

- Phase II – Expand marketing and deliver shrimp directly to customers

RC will introduce Plant I products to the local restaurants and seafood markets. RC will market our products by word of mouth from the retail outlet and the use of Marketing and Media (see below). Additionally, RC will deliver the product to the customer locations and continue our marketing and sales plan directly to the commercial purchasing customer at their site.

- Phase III – Promote online market

RC will perform an online test trial to access the online market. The test will provide RC with the information necessary to establish the opportunity, value, and appropriate marketing strategy of the online market as we bring plants 2-6 into production.

Prior to the launch of our retail outlet RC will take full advantage of all advertising tools available to us. RC will reach our markets through social media, the company website (designed for branding awareness including videos of the products and informing the community of our commitment to quality shrimp in a sustainable business, and to promote online sales). Additionally, we will run various radio spots and internet infomercials which target our premium shrimp customers.

The metropolitan area of Phoenix is the 11th largest by population in the United States (>4,749,000). The Gross Metro Product exceeds $234 Billion. The metro area encompasses Arizona State University and numerous high-tech and telecommunications companies that have recently relocated to the area. Due to the warm climate in winter, Phoenix benefits greatly from seasonal tourism and recreation. The military has a significant presence in Phoenix with Luke Air Force Base located in the western suburbs. Foreign governments have established 30 consular offices and eleven active foreign chambers of commerce and trade associations in the city as well. Because the average American consumes >4lb. of shrimp per year, the Phoenix market for shrimp far exceeds the anticipated capacity of RC’s Plant 1 production.

RC’s retail outlet will help us establish our price points for the commercial market, evaluate our daily sales, help create a further demand throughout the region and grow the brand. In addition, we will be positioned to introduce our premium branded shrimp too many of the 2,400 restaurants throughout the Greater Phoenix Metropolitan Area.

Stage III

Marketing and Sales Plan

RC will build and operate is first full scale 1.3MM lb./yr. (Plant 2). Plant 2 will generate >3500 lbs./day.

RC will continue to operate our retail outlet. Shrimp will be available for sale every day. With RC’s Plant 1 and 2, we will be able to grow the restaurant and seafood markets that were created in Stage II Plant 1.

RC will supply the underserved fresh never frozen local market with our 26g Fresh Never Frozen at a target price of $16/lb. and the unmet live market demand in the Asian market with our 16g live shrimp year-round, at a target price of $14/lb. In addition, we will be positioned to meet the needs of our volume base commercial customers in our restaurant and seafood markets daily.

Additionally, based on the results of our online market test, RC will ramp up our nationwide online sales and marketing of both Fresh Never Frozen heads-on and heads-off shrimp. RC will grow our online presence anchored by our company website. RC State-of-the Art technology gives us the flexibility to ship fresh product anywhere in the United States. This packaging technology permits us to keep shrimp fresh never frozen, heads-on for 9-days and 17-days for the fresh never frozen, heads-off. RC will employ seafood companies that have existing distribution platforms which will allow us to drop ship directly to the consumer. Shrimp will be shipped by air freight or ground carrier as requested by the customer.

With Plant 1 and 2, RC expects to distribute our product to the local market with 1) our company owned delivery truck-based distribution logistics system, 2) to make our product available for pick up at designated locations at our plants or 3) pick up at our retail site. Customers can select its distribution service based on price and volume (Distribution Plan).

Stage IV

Marketing and Sales Plan – all this is for the future

What RC learns from our Stage II and Stage III marketing and sales experience will be used to help refine our marketing and sales plan and to help us select and site five additional 1.3MM lb./yr. (Full Plant) plants in proximity to cities nationwide.

RC’s marketing/distribution plan as detailed in Stage III will be refined, as appropriate, and replicated in each new city that RC builds a Full Plant. However, as RC’s brand becomes more well-known the retail location at a particular site may or may not be applicable.

Because RC plans to grow its shrimp as close to its local customers as practical the RC Distribution Plan described above should meet our customer and company needs. However, as our business grows, RC will always be open to bringing a better distribution solution to our customers. One of these opportunities might be to contract with a large seafood distributor. RC will be flexible to improve its distribution process.

The RC market plan is simple, but it will give us the foundation to achieve our marketing, sales, and distribution goals. As is always the case, as data is obtained and properly analyzed adjustments will be made as deemed appropriate.